We provide catalytic risk capital in the form of equity, investing in and co-developing infrastructure projects and platforms across Africa, south and southeast Asia. We work with a deliberate intention to expand the bankable pipeline of sustainable infrastructure projects and businesses in these geographies, mobilising further investment and helping to make them attractive to the private sector.

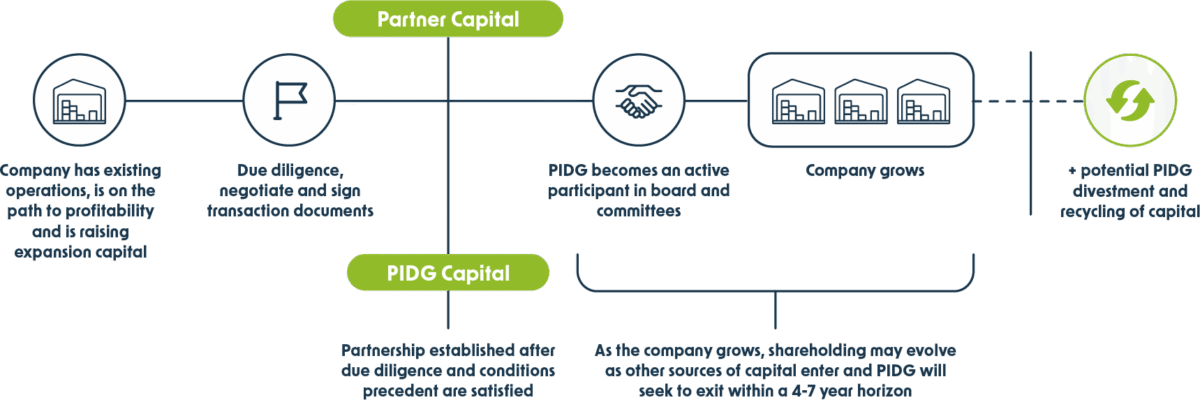

Through our investment capability, we can take a significant minority share, providing equity to close a financing gap; enabling companies to scale up innovative solutions, to pilot new products or enter new markets. This work also supports the development of domestic capital markets, unlocking new sources of infrastructure finance.

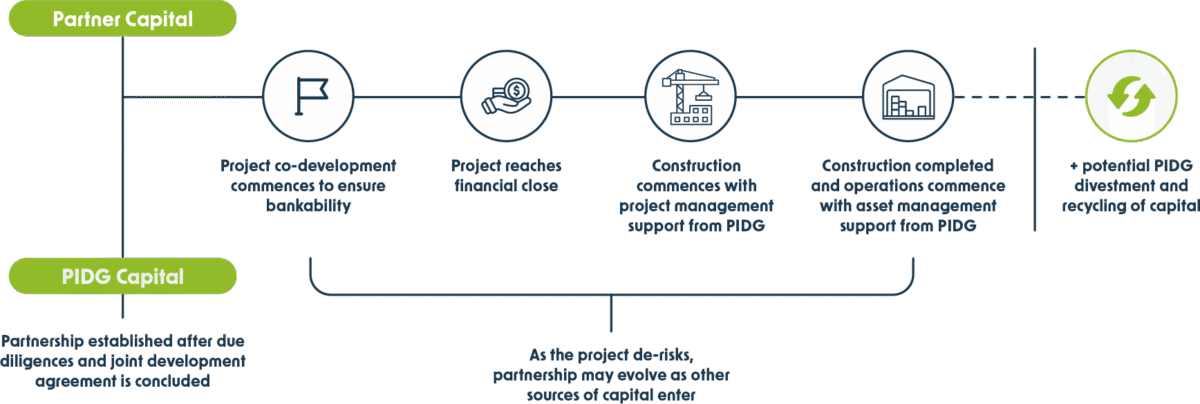

Our in-house asset management capability ensures that our projects and businesses are supported with project management, governance and operational expertise. We also ensure that the highest standards of health, safety, environmental, and social (HSES) governance, and business integrity are achieved throughout construction and operations.

Working with our partners, we seek to develop commercially attractive infrastructure assets which can be sold to responsible investors, recycling our Owner funding into new, sustainable infrastructure projects.

Adopting a hands-on approach to ensure that our investments thrive, we bring extensive project development leadership and expertise to each of our projects and investments.