Vietnam’s energy sector is facing a complex set of challenges, primarily driven by its rapidly growing economy and the need to transition to a more sustainable energy mix. According to the government’s Power Development Plan 8 (PDP8), Vietnam will need approximately USD135 billion to increase its electricity generation capacity by 2030. Solar energy is now an important component of the country’s strategy to address this gap. However, it was considered ‘unbankable’ in 2018, when PIDG first invested in a utility-scale solar farm through InfraCo, its project development solution. Getting private sector investment into the sector was challenging due to several factors, including the requirement for local rather than international arbitration, risk of the contract being cancelled with only 12 months of revenues payable as compensation and overall, an insufficient protection from curtailment.

This PIDG investment was a first of its kind for Vietnam. PIDG directly addressed the risk concerns, providing comfort to lenders about the perceived barriers to implementation. We took a multi-pronged approach to make this investment happen. It involved extensive modelling exercises to demonstrate that it was very unlikely for the project to be cancelled due to Vietnam’s future energy needs. Curtailment risk was addressed by connecting to a second transmission line with more spare capacity. Finally, we led discussions between the debt provider and Vietnamese authorities to address concerns around arbitration and ensuring the PPA was honoured.

With this investment, PIDG mobilised USD147 million in international equity and debt finance.

1.8GW of solar capacity has been added in Vietnam since PIDG’s investment in Ninh Thuan.

To further consolidate the transformative nature of this investment, PIDG was able to fully divest its direct and residual interests in the project by 2021 to the private clean energy provider, EDPR Sunseap.

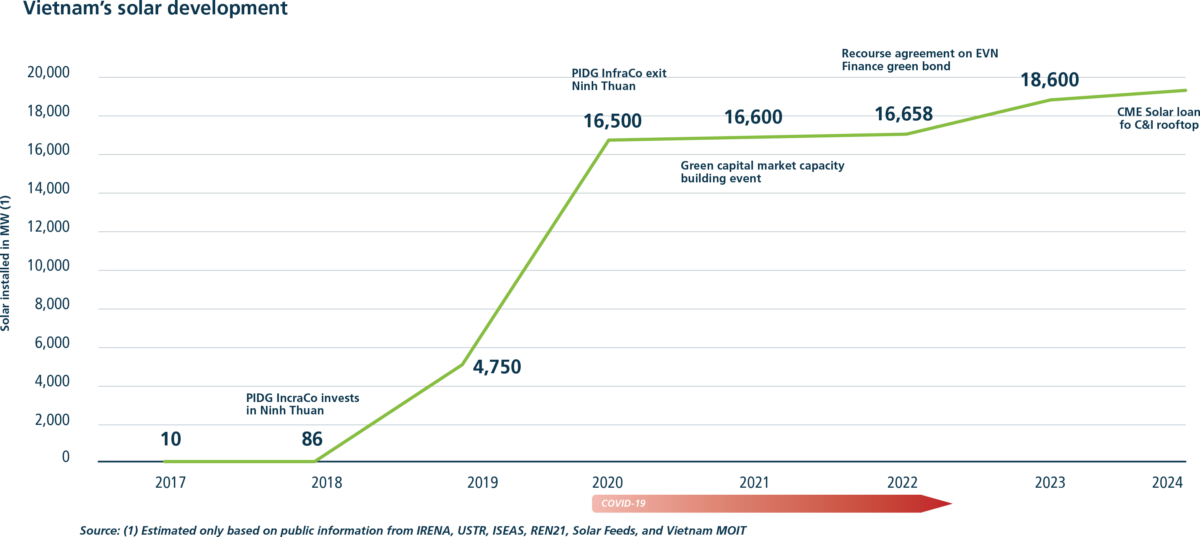

Making the first move in the sector, and demonstrating its real risk profile, PIDG InfraCo made the solar market attractive to other players, which is evident in the sharp rise in the country’s installed solar capacity from 86MW in 2018 to nearly 1900MW now.

We continued to engage with stakeholders to develop the capital market as an enabler of further growth in the solar sector. In 2021, PIDG’s guarantee arm, GuarantCo, organised a two-day green capital market event funded by PIDG technical assistance, which aimed at increasing market understanding of green bonds and loans. It brought together stakeholders interested in raising debt from green and climate capital markets to deliver infrastructure projects.

That effort led to GuarantCo providing a USD50 million equivalent in VND partial credit guarantee to support the issuance of Vietnam’s inaugural internationally verified green bond of USD75 million equivalent in VND in 2022. It allowed EVN Finance to provide longer term loans to green infrastructure projects aligned with its Green Bond Framework, including to rooftop and ground-mounted solar projects. This came at a time when the government increased the emphasis on renewable energy and called on the private sector to ramp up investment.

In 2024, a further USD20 million loan was extended by PIDG’s debt fund, Emerging Africa & Asia Infrastructure Fund, to CME Solar, a prominent player in Vietnam’s commercial and industrial (C&I) solar energy sector. It will support the development of over 260MWp of rooftop solar projects. This investment addresses a critical need, as coal-fired power still accounts for 45 per cent of Vietnam’s energy supply. The project will contribute to the country’s goal of increasing renewable energy share to c. 40 per cent by 2030.

PIDG’s continued engagement with stakeholders in Vietnam and these successive events have made it evident that Ninh Thuan Solar’s success boosted confidence and unlocked the local renewable energy market’s potential, making it attractive to local and international investors.

As Vietnam continues its development journey against a backdrop of mounting environmental challenges, an expanded set of pathways to securing infrastructure finance are necessary. A credit enhancement facility (CEF), which would issue local currency credit guarantees to improve the credit ratings of projects and developers approaching lenders for debt, could help further mobilise the private debt necessary for development.

Independent evaluators have found that no one today is concerned about the bankability of solar in Vietnam, a sharp contrast to what was seen before PIDG invested in Ninh Thuan, where developers found it impossible to attract investment because of concerns outlined above. PIDG’s progress in Vietnam demonstrates that blended finance structures can play a key role in bridging the gap between infrastructure projects needing long-term, local currency finance and investors seeking to diversify their portfolios and creating impact. By mobilising finance in effective and sustainable ways, market precedents come into place that open doors to greater private sector participation.